GrowthStateofMind

Active member

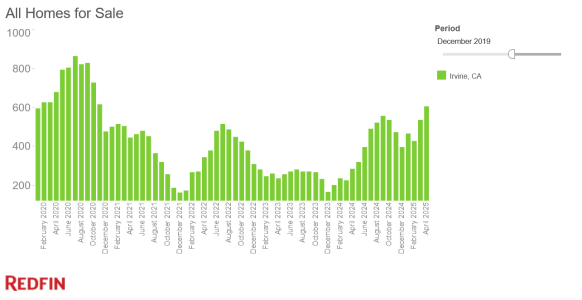

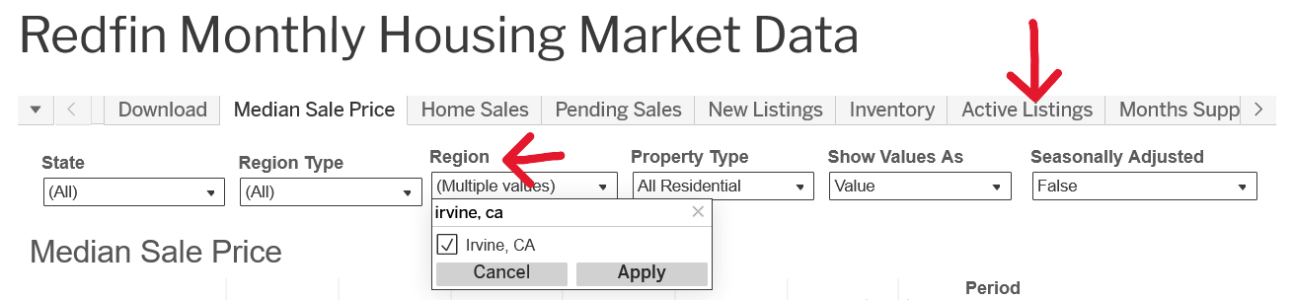

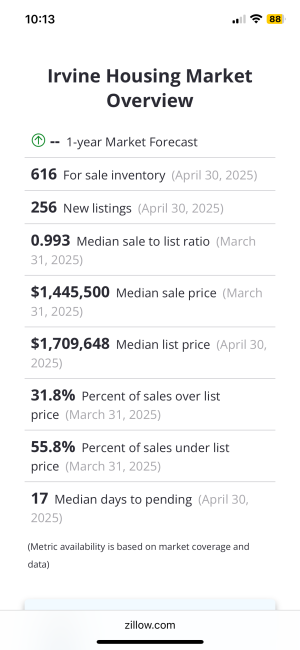

Not sure where to find last years data off the top of my head, but here’s this years thus farNot sure if this is the right thread but is there any data on the active listings YoY in Irvine vs this time last year?

Irvine, CA Housing Market: 2026 Home Prices & Trends | Zillow

The average home value in Irvine, CA is $1,500,919, up 0.6% over the past year. Learn more about the Irvine housing market and real estate trends.