sleepy5136

Well-known member

Vegas is waiting for you.Can these prices drop for peasants like me shopping in that 1 million range?

Vegas is waiting for you.Can these prices drop for peasants like me shopping in that 1 million range?

Anywhere on the West Coast?Anyone spending more than 2.5m+ on a cookie cutter home is crazy. With 2.5m I can buy land 2X of Irvine and do a custom build in Hawaii.

Options are endless with 2.5m in the west.Anywhere on the West Coast?

Look at Eastvale, there are some new builds.Can these prices drop for peasants like me shopping in that 1 million range?

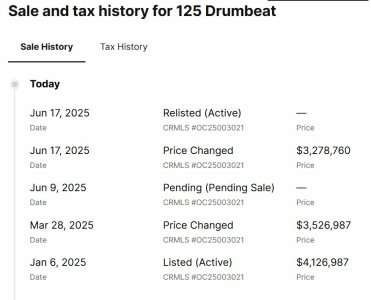

And another one.

View attachment 10453

127 Drumbeat, Irvine, CA 92618 | Zillow

127 Drumbeat, Irvine CA, is a Single Family home that contains 3365 sq ft and was built in 2025.It contains 4 bedrooms and 5 bathrooms. The Zestimate for this Single Family is $3,239,700, which has decreased by $206,023 in the last 30 days.www.zillow.com

Michael Mei chasing the market down $200K at a time. When do you think he will stop?

View attachment 10526

Is this guy supposed to be a professional?

View attachment 10527

Fifteen years ago was the cyclical bottom after the GFC. So yes, those that waited and bought after the crash did extremely well. Those that "bought when they could" from 2005-07 with easy financing suffered a blood bath, and many of those short sales were featured on the IHB.Finally checked out some model homes over the weekend, Lily in the Great Park by Taymo, Azul by CalPac and Cielo by Shea.

We didn't go into Azul because it looked like the standard box on box design (which Lily was) but we really liked the Cielo Shea designs. The central exposed stairs was nice in the Plan 1 and the 2-story ceilings for the family room in all plans was refreshing to see.

The small master closets were not very big (except for plan 3) and although the Plan 2 had 2 master closets, they were tiny.

I'm surprised none of those plans had a master wet room where the shower and tub were combined in a sauna type area.

Can't believe these are $2-$3m homes. 15 years and new houses more than doubled.

Time heals all wounds.... which is why you shoild buy whan you can.

Hindsight... but back in 2010... most kept saying it would still keep dropping. That was only a few years after the peak and there were many who were still in doubt.Fifteen years ago was the cyclical bottom after the GFC. So yes, those that waited and bought after the crash did extremely well. Those that "bought when they could" from 2005-07 with easy financing suffered a blood bath, and many of those short sales were featured on the IHB.

I hope we get a depression just to prove you right. Either that or gen z/a will revolt and forcibly take homes for themselves.Fifteen years ago was the cyclical bottom after the GFC. So yes, those that waited and bought after the crash did extremely well. Those that "bought when they could" from 2005-07 with easy financing suffered a blood bath, and many of those short sales were featured on the IHB.

And yet I saw on another thread some recent new home buyers are disgruntled about the $1 million price cuts on their models. I suppose time will heal their wounds as well, but it doesn't change the fact that they lost $1 million on their new homes, and they are stuck until prices recover.

I hope we get a depression just to prove you right. Either that or gen z/a will revolt and forcibly take homes for themselves.

Like I said… you think gen z and alpha are going to accept the terrible state of opportunities for them just so home owners can stay rich at their expense? They will have a revolution. Better to have peaceful wealth transfer than to have violent wealth confiscation like all those countries you cited.

they stay on phone and avoid real hunman contact at all costs. i sure hope they can unite and rise ... in any capacityLike I said… you think gen z and alpha are going to accept the terrible state of opportunities for them just so home owners can stay rich at their expense? They will have a revolution. Better to have peaceful wealth transfer than to have violent wealth confiscation like all those countries you cited.

probably what will happen is people will finally realize it's OK to tax land more and/or rent seeking on land value increases, and capital will flow out from RE speculation and into more productive areas of the economy.Like I said… you think gen z and alpha are going to accept the terrible state of opportunities for them just so home owners can stay rich at their expense? They will have a revolution. Better to have peaceful wealth transfer than to have violent wealth confiscation like all those countries you cited.

probably what will happen is people will finally realize it's OK to tax land more and/or rent seeking on land value increases, and capital will flow out from RE speculation and into more productive areas of the economy.

That doesn't mean prices will drop but it certainly could slow the appreciation level (hopefully).

Clearly I hit a nerve while dismantling the "buy when you can" advice.Hindsight... but back in 2010... most kept saying it would still keep dropping. That was only a few years after the peak and there were many who were still in doubt.

There were also many who bought during peak, kicked the can, or held... and made out like a bandit, esp if they used O-ARMs and the interest rates dropped so they were making positive minimum payments. The short sales/foreclosures on the IHB was not a majority % of people who bought at peak and that's also why Larry ran out of material sooner than even he expected.

Show me the numbers of this blood bath. I did some data analysis back in 2012 on TI that got cross-posted to IHB and the foreclosure tsunami that was supposed to make prices drop further never happened. The only "bloodbath" was the the dashed expectations of a lot of speculators... which includes myself. Yes... I thought prices would drop more back in 2008... but by 2010... I already knew it wasn't going the way that people thought and was in the minority. 2013... you still thought people were catching knives... 2018 you still kept saying it wasn't a good time to buy. 2020 Covid you finally feel your black swan was here to land... but what happened then? In fact, you even bought without telling anyone it was "the time to buy".

I can admit when I'm wrong but you...

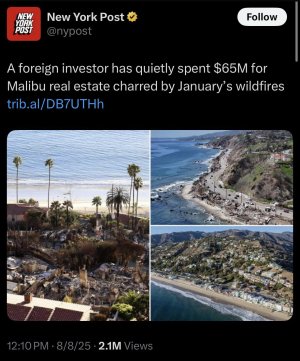

The issue is domestic money has to compete with foreign mView attachment 10535

The best time to buy was 2010 after the GFC blood bath, and the second best was 2020 after the Irvine housing downturn. I just so happen to have purchased my last two residences in those years and the gains have been unbelievable.Which was the best time to buy?

2005

2010

2013

2018

2020

2022