panda

Well-known member

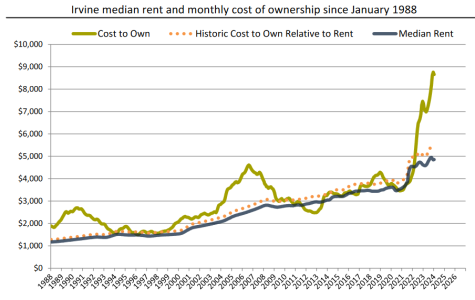

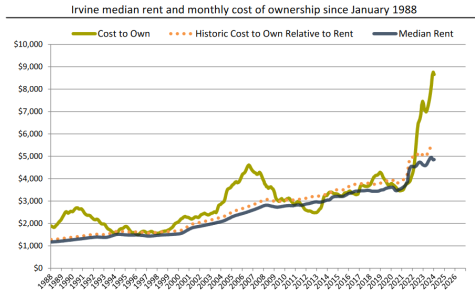

I understand that the FCB is loaded with cash, but this condo seems to be a horrible investment for cash flow? Wouldn't it better to put this cash in a CD and collect $64k in interest income without having to deal with tenants, toilets, and termites with no risk? With the carrying cost (HOA, Taxes, Melloroos, Vacancy etc), the FCB would be lucky to make a 2-3% yield on this tiny condo in Woodbury. Perhaps the FCB doesn't care.

This is no buyer with mortgage. It’s all cash investment considered how fast it went in and out of escrow. It’ll be up for rent next week.

Last edited: