Cornflakes

Active member

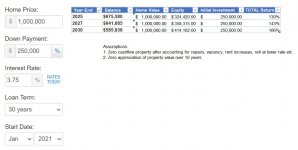

So, I have been comparing residential RE vs commercial 1031 DST. Ran some numbers and the DST is not making any sense to me. Am I missing something big here?

FYI - I got a historical commercial DST performance numbers and they show that avg holding period of 7 some years and following total return over hundreds of deals in past 15 years. SO, that is my benchmark. Yes, I am calculating exactly same way the total retrun in my screenshot as they do for DSTs.

Inland: Of Inland?s sixty-eight (68) full-cycle offerings, fifty-eight (58) had a Total Return greater

than 100%. Inland reported an average Total Return of 130.3% across all sixty-eight (68) offerings

(weighted based on purchase price of the properties).

Passco: Of Passco?s sixty-three (63) full-cycle offerings, fifty-three (53) had a Total Return

greater than 100%. Passco reported an average Total Return of 135.6% across all sixty-three

(63) offerings (weighted based on purchase price of the properties).

Bluerock: Of Bluerock?s forty-five (45) full-cycle offerings, thirty-nine (39) had a Total Return

greater than 100%. Bluerock reported an average Total Return of 149.7% across all forty-five

(45) offerings (weighted based on purchase price of the properties).

My questions is, why would/should I lock my money in commercial DST where risk is higher, liquidity is less, and I have zero control. It seems that bunch of lawyers, property managers, trustees and all get compensated well at the investor's dime in these DST deals.

FYI - I got a historical commercial DST performance numbers and they show that avg holding period of 7 some years and following total return over hundreds of deals in past 15 years. SO, that is my benchmark. Yes, I am calculating exactly same way the total retrun in my screenshot as they do for DSTs.

Inland: Of Inland?s sixty-eight (68) full-cycle offerings, fifty-eight (58) had a Total Return greater

than 100%. Inland reported an average Total Return of 130.3% across all sixty-eight (68) offerings

(weighted based on purchase price of the properties).

Passco: Of Passco?s sixty-three (63) full-cycle offerings, fifty-three (53) had a Total Return

greater than 100%. Passco reported an average Total Return of 135.6% across all sixty-three

(63) offerings (weighted based on purchase price of the properties).

Bluerock: Of Bluerock?s forty-five (45) full-cycle offerings, thirty-nine (39) had a Total Return

greater than 100%. Bluerock reported an average Total Return of 149.7% across all forty-five

(45) offerings (weighted based on purchase price of the properties).

My questions is, why would/should I lock my money in commercial DST where risk is higher, liquidity is less, and I have zero control. It seems that bunch of lawyers, property managers, trustees and all get compensated well at the investor's dime in these DST deals.