irvinehomeowner

Well-known member

Okay, so I've been trying to find an example of some closed resales on Redfin last year to compare to a closed resale today to see how much savings we are talking if you waited.

I used the criteria of SFR, 4br/3ba, 2250sft+, 1 year of closed sales and tried to find something in the same general area.

https://www.redfin.com/city/9361/CA...-baths=3,min-sqft=2.25k-sqft,include=sold-1yr

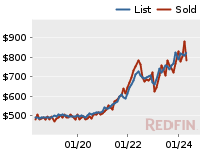

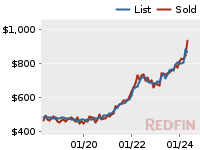

This follows along the line of what price range/product most TI members are looking for (the middle finger graph:https://www.talkirvine.com/index.php/topic,16641.0.html)and also if I were shopping last year and now, it's the stock I would be looking at.

The lowest price listings were all closed last year... starting at $799k for this one:

4br/3ba 2655sft sold 7/31/18 https://www.redfin.com/CA/Irvine/39-Murasaki-St-92617/home/22790592

Not sure what is up with that one because it seems like $799k is a low price, it looks like it's campus housing but I'm not familiar with that area.

I think the lowest one that sold this year is in West Irvine for $880k

5br/3ba 2268sft sold 2/26/18https://www.redfin.com/CA/Irvine/12-Proclamation-Way-92602/home/4793117

But there were 3 resales that sold lower last year:

$833k 4br/3ba 2591sft sold 9/17/18 (comments say it's a fixer upper)https://www.redfin.com/CA/Irvine/11-Blazing-Star-92604/home/4683713

$865k 4br/3ba 2344sft sold 8/31/18 (3CWG!!)https://www.redfin.com/CA/Irvine/13791-Stampede-Cir-92620/home/4776602

$870k 5br/3ba 2626sft sold 4/19/18 (another 3CWG!!)https://www.redfin.com/CA/Irvine/4091-Blackfin-Ave-92620/home/4777857

This is by no means and in-depth data analysis, I just sorted by price (within the search criteria) and these were the first ones to come up. Maybe there are better savings once you get to the $1m-1.5m range.

Maybe one of you can find better examples but I think it's going to skew as a push because it seems just on first glance that prices are around the same or even slightly higher (at least for the search criteria I mentioned above).

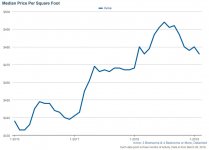

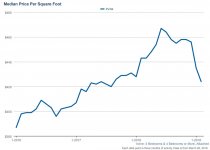

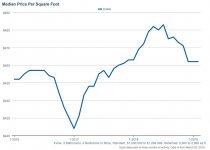

Now I understand price lags (that was mentioned in the poll thread) but at the same time, Irvine seems to adjust up more quickly than down. Just looking at Trulia and the Irvine trend graph already shows an uptick of prices from a median of $810k in Feb to $815k in March.

https://www.trulia.com/real_estate/Irvine-California/market-trends/

Are the new homes cheaper this year than last year? How is Delano doing?

I used the criteria of SFR, 4br/3ba, 2250sft+, 1 year of closed sales and tried to find something in the same general area.

https://www.redfin.com/city/9361/CA...-baths=3,min-sqft=2.25k-sqft,include=sold-1yr

This follows along the line of what price range/product most TI members are looking for (the middle finger graph:https://www.talkirvine.com/index.php/topic,16641.0.html)and also if I were shopping last year and now, it's the stock I would be looking at.

The lowest price listings were all closed last year... starting at $799k for this one:

4br/3ba 2655sft sold 7/31/18 https://www.redfin.com/CA/Irvine/39-Murasaki-St-92617/home/22790592

Not sure what is up with that one because it seems like $799k is a low price, it looks like it's campus housing but I'm not familiar with that area.

I think the lowest one that sold this year is in West Irvine for $880k

5br/3ba 2268sft sold 2/26/18https://www.redfin.com/CA/Irvine/12-Proclamation-Way-92602/home/4793117

But there were 3 resales that sold lower last year:

$833k 4br/3ba 2591sft sold 9/17/18 (comments say it's a fixer upper)https://www.redfin.com/CA/Irvine/11-Blazing-Star-92604/home/4683713

$865k 4br/3ba 2344sft sold 8/31/18 (3CWG!!)https://www.redfin.com/CA/Irvine/13791-Stampede-Cir-92620/home/4776602

$870k 5br/3ba 2626sft sold 4/19/18 (another 3CWG!!)https://www.redfin.com/CA/Irvine/4091-Blackfin-Ave-92620/home/4777857

This is by no means and in-depth data analysis, I just sorted by price (within the search criteria) and these were the first ones to come up. Maybe there are better savings once you get to the $1m-1.5m range.

Maybe one of you can find better examples but I think it's going to skew as a push because it seems just on first glance that prices are around the same or even slightly higher (at least for the search criteria I mentioned above).

Now I understand price lags (that was mentioned in the poll thread) but at the same time, Irvine seems to adjust up more quickly than down. Just looking at Trulia and the Irvine trend graph already shows an uptick of prices from a median of $810k in Feb to $815k in March.

https://www.trulia.com/real_estate/Irvine-California/market-trends/

Are the new homes cheaper this year than last year? How is Delano doing?