Liar Loan

Well-known member

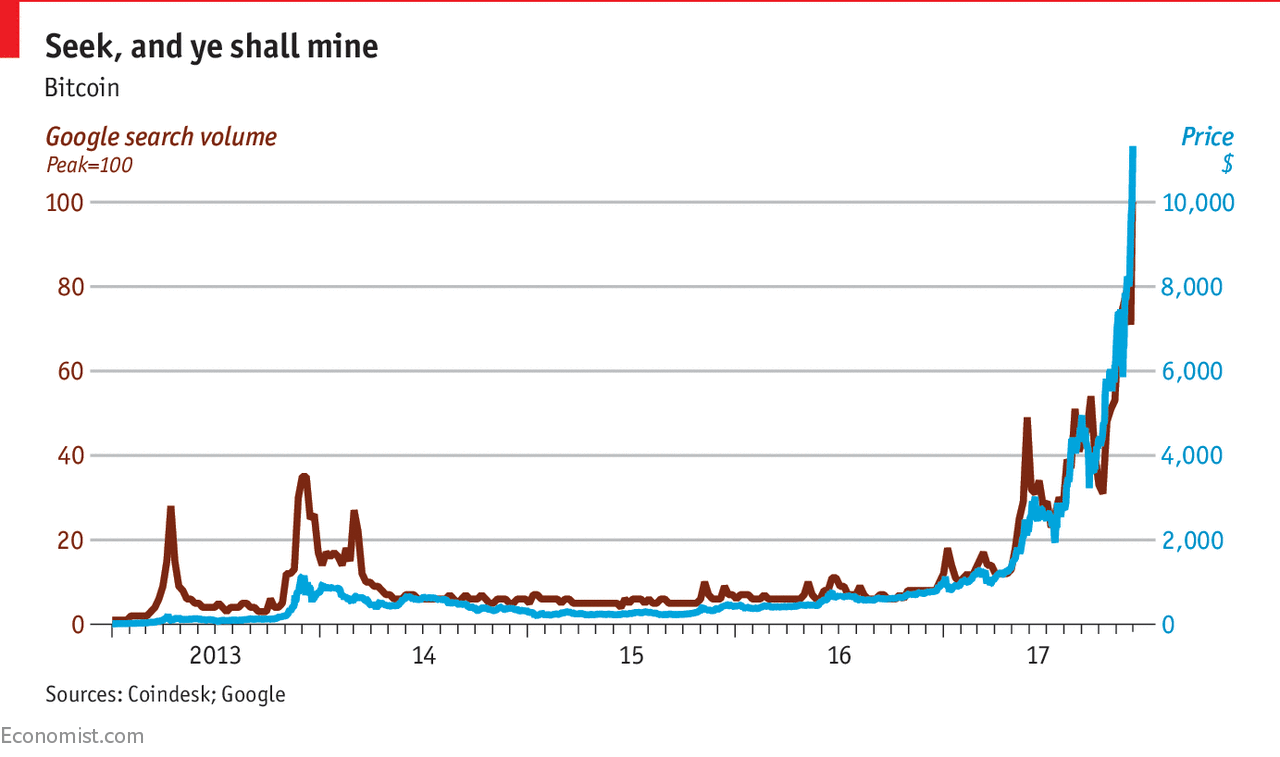

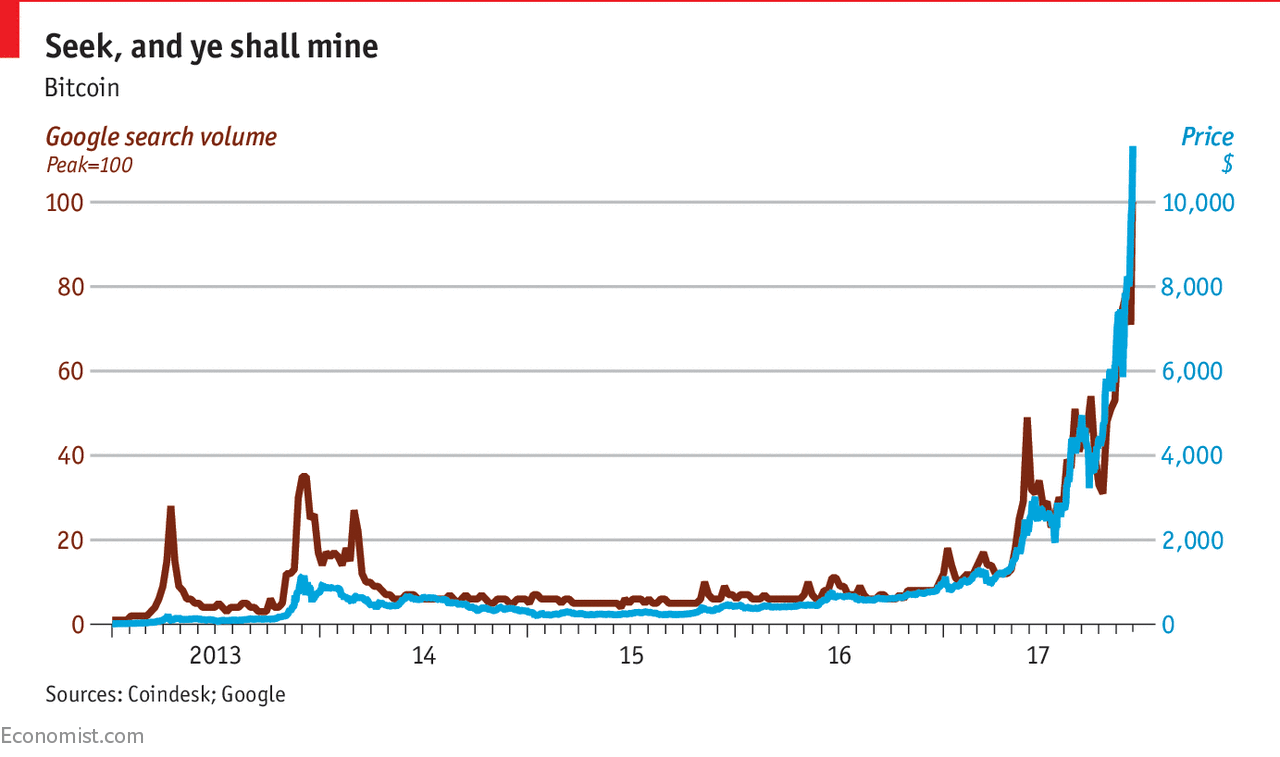

Bitcoin just gained another $1,000 in price hitting $11,000 this morning, before investors started cashing in their gains and driving the price lower. The currency has gone up about 10x in value this year.

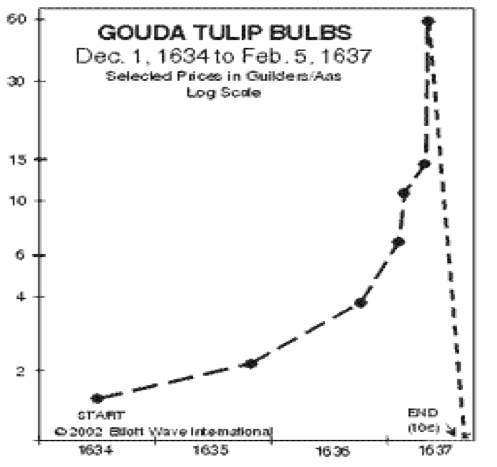

Similarly, in the year 1637 tulip bulb mania swept Holland and the price of bulbs increased by 10x or more before crashing spectacularly:

Here's how insane the Dutch tulip bubble was according to Investopedia:

The part about selling to hapless foreigners reminds me of Irvine a little bit, but my question is how high does Bitcoin go before experiencing a similar crash?

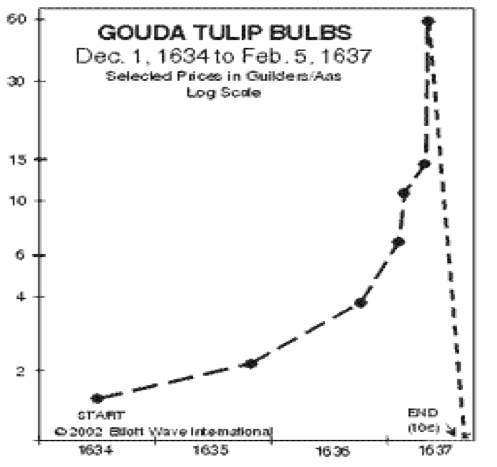

Similarly, in the year 1637 tulip bulb mania swept Holland and the price of bulbs increased by 10x or more before crashing spectacularly:

Here's how insane the Dutch tulip bubble was according to Investopedia:

Soon, prices were rising so fast and high that people were trading their land, life savings, and anything else they could liquidate to get more tulip bulbs. Many Dutch persisted in believing they would sell their hoard to hapless and unenlightened foreigners, thereby reaping enormous profits.

The part about selling to hapless foreigners reminds me of Irvine a little bit, but my question is how high does Bitcoin go before experiencing a similar crash?