irvinetabby

New member

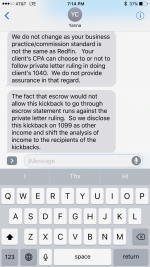

I bought a new build and my realtor gave me back half of the commission. However, she asked for my SSN and later sent me a 1099-MISC for the entire rebate amount!

I assume this is now considered my "other income" and I have to pay taxes on this, making my real rebate lot smaller. I've never heard of this. Any input?

Thanks!

I assume this is now considered my "other income" and I have to pay taxes on this, making my real rebate lot smaller. I've never heard of this. Any input?

Thanks!