panda

Well-known member

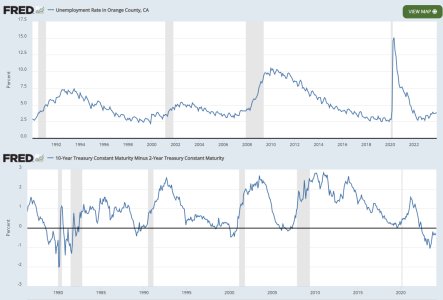

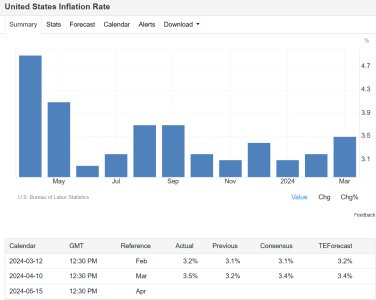

Looks like there will be a delay on rate cuts.

www.barrons.com

www.barrons.com

CPI Report News Today: March Inflation Comes In Hot, Dashing Hopes for Fed to Cut Rates

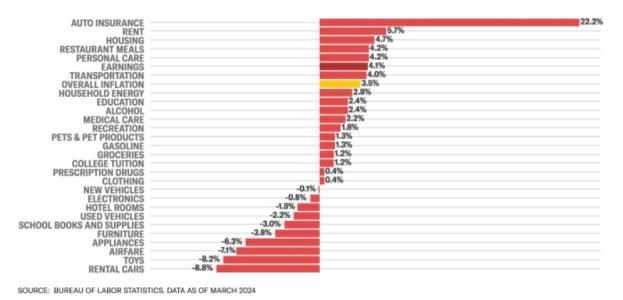

The March consumer price index data, released today, showed inflation rose to a 3.5% pace year over year, faster than February's 3.2% rate. The core data exceeded expectations too. The news is likely to delay interest-rate cuts by the Federal Reserve.